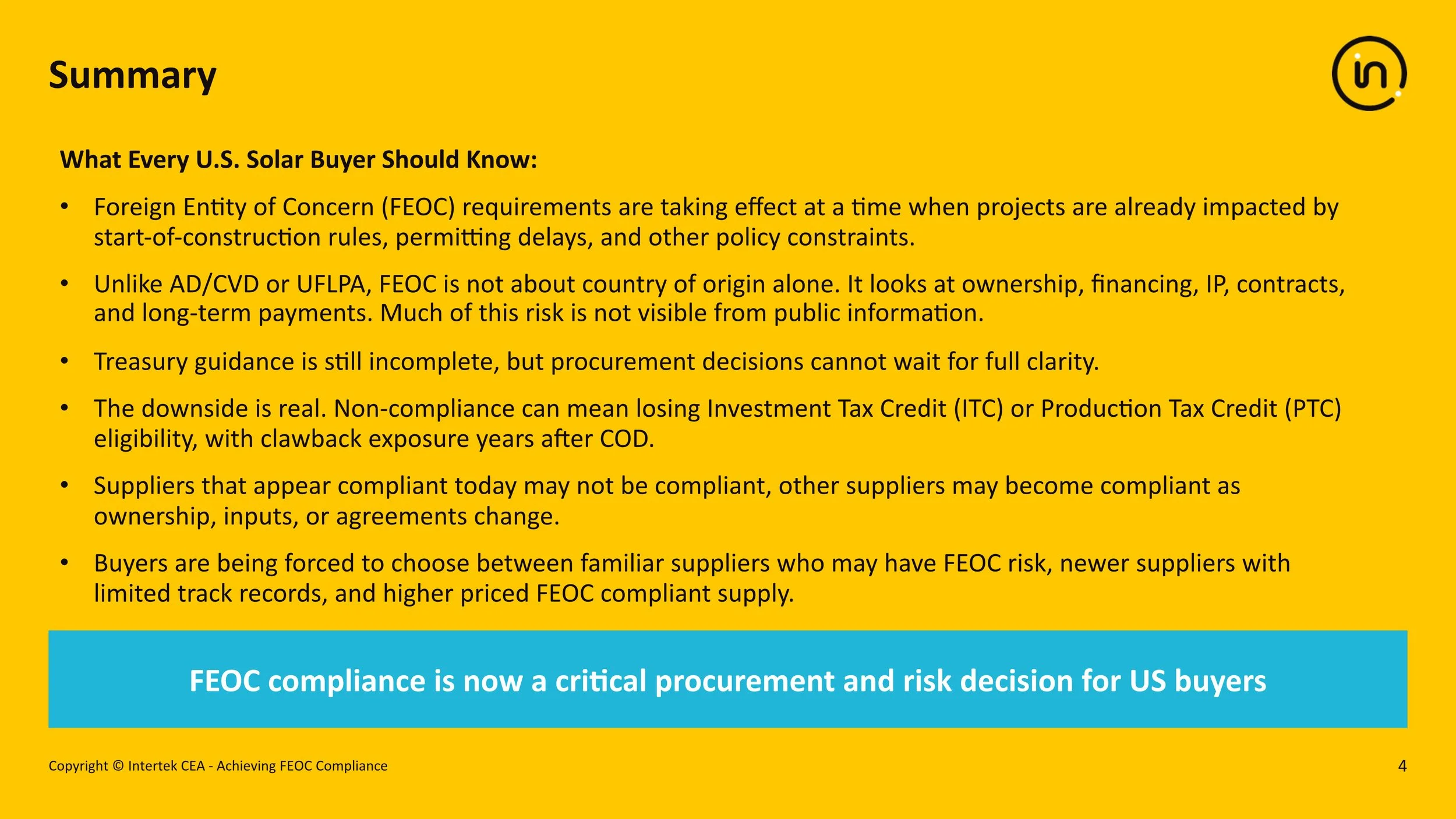

Achieving FEOC Compliance: What Every U.S. Solar Buyer Should Know

Foreign Entity of Concern (FEOC) rules are reshaping the risk profile of U.S. solar projects.

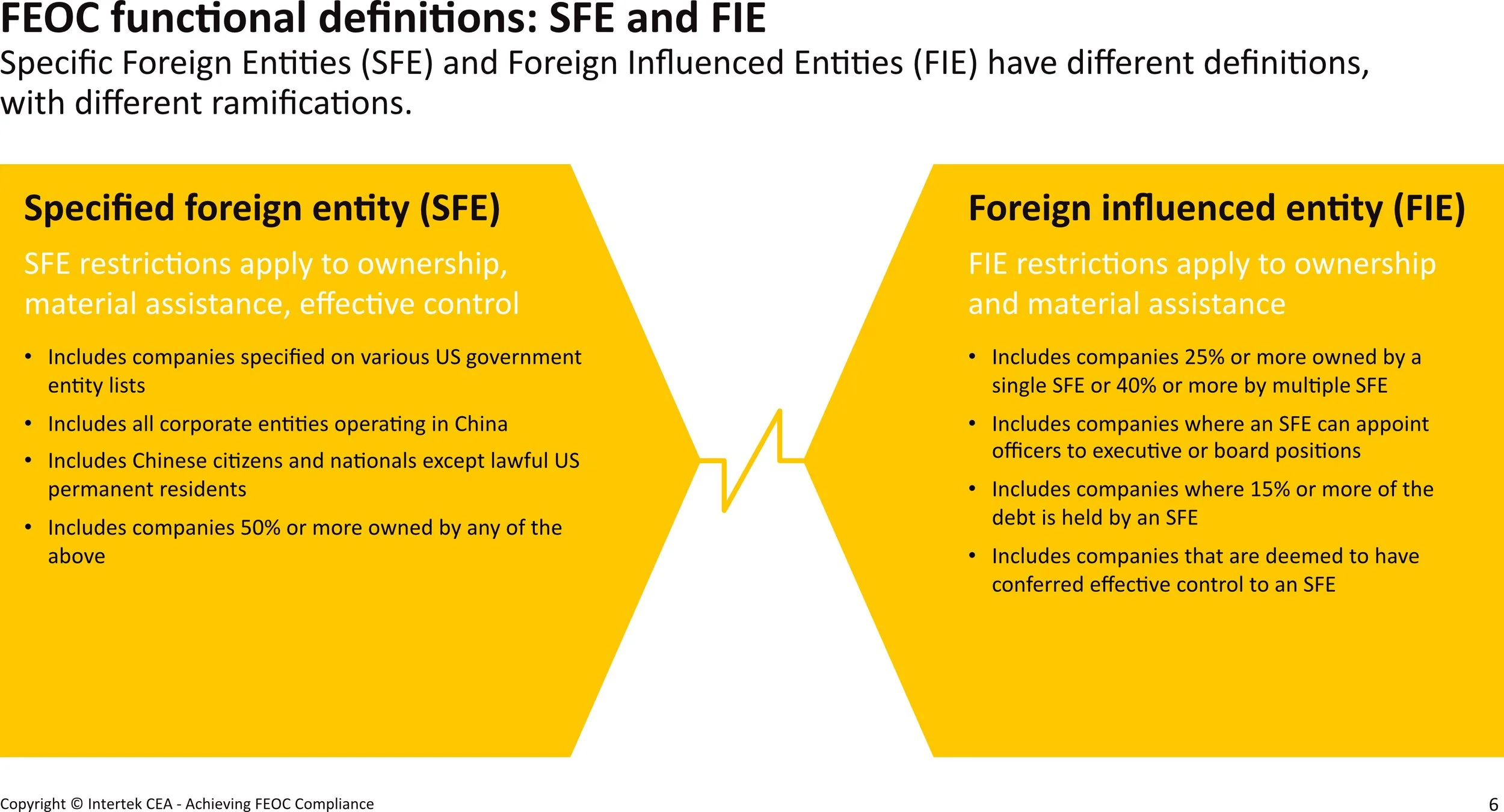

Foreign Entity of Concern (FEOC) restrictions are changing how U.S. solar buyers must evaluable tax credit risk. The rules target not just where components are made, but the ownership and influence behind the companies that make them.

Buyers must make procurement decisions under tightening incentive timelines, with limited ability to change suppliers once projects advance. Misjudging FEOC exposure can put ITC or PTC eligibility at risk and create audit exposure years after projects are installed.

This report is designed to help U.S. solar buyers answer three practical questions:

How to interpret the FEOC rules as they are written today

How to assess which suppliers present unacceptable risk

How to document compliance in a way that will hold up under future review.