Comprehensive Market Intelligence for the Energy Transition

Have a Question or Need Assistance?

Leverage our deep industry insights to navigate the dynamic clean energy landscape with confidence

The energy transition has created huge business opportunity amidst massive complexity. Geopolitical forces, aggressive technology advancement, and volatile pricing are inducing structural changes to value chains, complicating procurement strategies, and posing risks to project profitability. The breakneck pace of supply expansion in the Photovoltaic (PV) and Energy Storage System (ESS) sectors has made supplier evaluation and monitoring paramount. Amid these complexities, we are here to provide clarity and direction.

What sets us apart is that we are not just observers — we are at the table when supply agreements are negotiated, in the factory watching production, and in the field identifying and fixing problems. This hands-on presence gives us a perspective few can match, allowing us to surface risks and opportunities as they emerge.

Our market intelligence services deliver a comprehensive understanding of global supply, technology, pricing, and policy for the PV and energy storage sectors. By combining on-the-ground experience with design and technical know-how, we provide actionable insights into the inner workings of the industry. From supply dynamics and pricing developments to technology evolution and policy analysis, we equip you to navigate this rapidly evolving landscape effectively — ensuring you’re not just keeping pace, but strategically positioned to capitalize on change.

How can I stay on top of the complex market dynamics in clean energy technologies and supply chains?

-

Production capacity

Regional investment

Value chain expansion

Supplier profiling

-

Full value chain analysis

Cost to price waterfall

Regional cost deltas

Raw material impacts

-

Product roadmaps

Performance specifications

Supplier positioning

-

Trade policy

Supply/demand incentives

Assessing the Impact of Foreign Entity of Concern (FEOC) Restrictions on U.S. PV & BESS Supply Chains

This service provides actionable market intelligence to solar PV and energy storage developers, who are developing procurement strategies that account for FEOC restrictions within the One Big Beautiful Bill Act (HR1) that may limit the availability of commercially viable options, access to critical tax incentives, and impact project development timelines.

What we do:

Regulatory impact analysis: Analyze HR1 FEOC definitions (ownership/control, material assistance, payments/IP) against Section 45X eligibility for equipment suppliers and outline practical mitigation strategies for developers to preserve access to Section 45Y/48E tax credits.

Facility screening & capacity outlook (PV and BESS): Deliver a dataset of U.S. PV and BESS production facilities, detailing facility ownership, location, supply-chain node, nameplate capacity, and COD timing; screening each production asset for potential FEOC exposure and likely outcomes (e.g., cancellation, ownership/licensing changes), culminating in a five-year FEOC-compliant capacity outlook.

Supply-risk implications: Characterize the commercial risks of potential supply interruptions for at-risk facilities and associated component suppliers, informing critical procurement and scheduling decisions.

Deliverable & timing:

A concise analysis summarizing projected capacities, risks, and timelines, delivered in 2-3 weeks.

Net result: clear, actionable intelligence so you can qualify suppliers, procure, and plan projects with confidence under evolving FEOC rules.

Latest Market Intelligence Insights

Foreign Entity of Concern (FEOC) restrictions are reshaping tax credit risk for U.S. solar buyers by targeting both supply chains and company ownership. This report helps buyers interpret the rules as written, assess supplier risk, and document compliance that will stand up to future review.

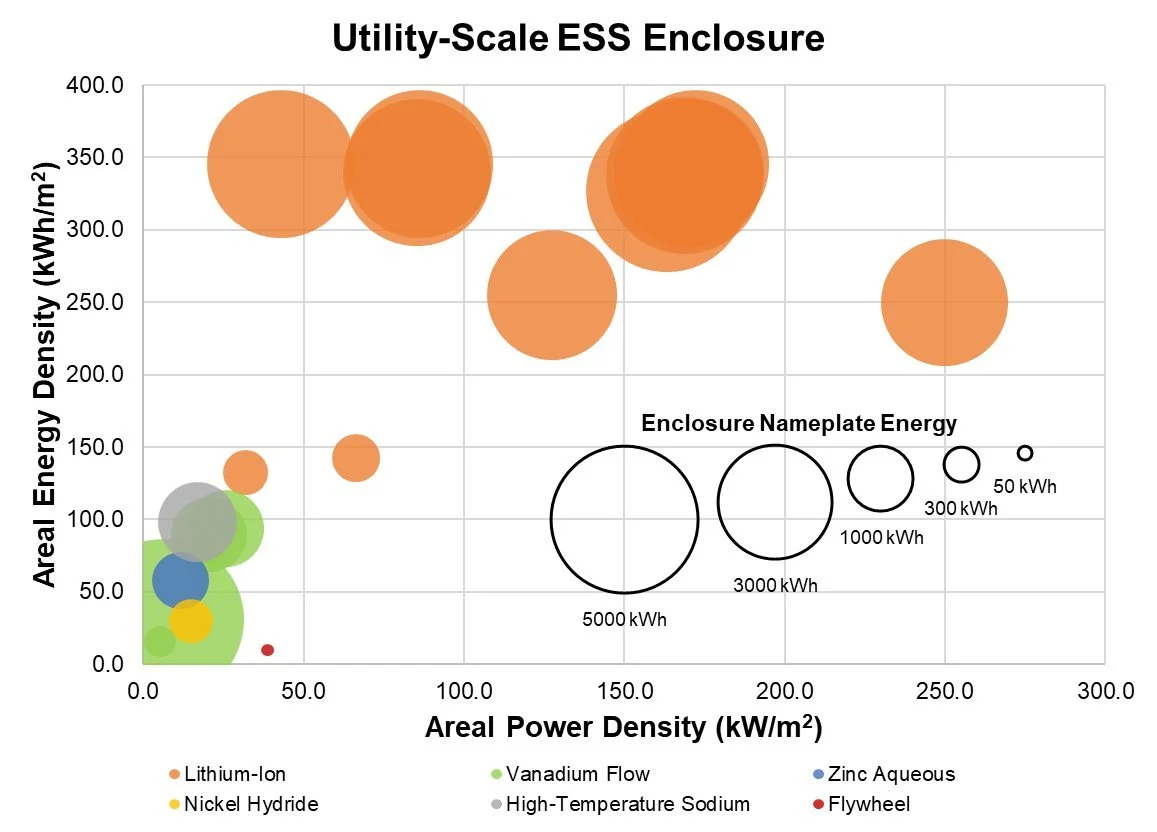

The quarterly Energy Storage STPR delivers global and regional supply chain analysis, technology trends, and policy insights, and this quarter focuses on cell product roadmaps toward larger form-factor cells and the emerging role of alternative technologies for UPS applications in the expanding data center market.

The ESS Price Forecasting Report provides an in-depth five-year forecast for the price of a DC battery container, including battery cells, modules, racking, and additional balance of system needed for a containerized battery system.

The PV SMIP provides a comprehensive and unbiased analysis of the top PV module manufacturers in the world. It offers detailed insights into capacities, technology, and efficiency roadmaps, along with Manufacturing, Capacity, and Technology (MCT) ratings for each supplier.

The latest Energy Storage System (ESS) Supplier Market Intelligence Report includes concise and standardized analyses of major LIB cell suppliers and BESS integrators, focusing on global production capacities, product portfolios, and notable projects.

Energy Storage News: Intertek CEA’s battery energy storage expert, Aaron Marks, explains that building U.S. domestic energy storage manufacturing capacity will require more than simply limiting foreign participation.

In this Energy Storage Summit USA webinar, Intertek CEA’s experts break down the top things every buyer should do to prepare for FEOC compliance — with practical guidance you can turn into action.

The quarterly published PV STPR covers global and regional supply chain analysis, technology trends, and regional policy analysis.

The PV Price Forecasting Report provides independent market intelligence on changes in global supply chains and accurate forecasts for supply price scenarios based on technologies, materials, manufacturing regions and target markets, as well as supply and demand forecasts and analysis.

In this webinar, Dan Finn-Foley, Director of Energy Storage Market Intelligence at Intertek CEA, joins experts at Orennia to discuss the outlook on trends and FEOC elements affecting storage

The PV SMIP provides a comprehensive and unbiased analysis of the top PV module manufacturers in the world. It offers detailed insights into capacities, technology, and efficiency roadmaps, along with Manufacturing, Capacity, and Technology (MCT) ratings for each supplier.

In this pv magazine USA Week session, Joseph Johnson, Associate Director of Market Intelligence, shares his insights on the challenges facing the U.S. solar supply chain, the drive toward domestic manufacturing, and strategies for navigating trade restrictions and compliance.

Christian Roselund, Intertek CEA’s Senior Policy Analyst, joins the SunCast Media Podcast to decode how FEOC is reshaping the way projects are sourced, engineered, financed, and papered across the U.S. solar and storage market.

The latest Energy Storage System (ESS) Supplier Market Intelligence Report includes concise and standardized analyses of major LIB cell suppliers and BESS integrators, focusing on global production capacities, product portfolios, and notable projects.

The quarterly Energy Storage STPR provides global and regional supply chain analysis, technology trends, and policy insights. This quarter focuses on innovations in container and system layout efficiency, as well as the UK’s new cap-and-floor regime for long-duration energy storage.

The ESS Price Forecasting Report provides an in-depth five-year forecast for the price of a DC battery container, including battery cells, modules, racking, and additional balance of system needed for a containerized battery system.

Christian Roselund, Senior Policy Analyst at Intertek CEA, joins the Clean Power Hour podcast to break down the intricate web of rules, tariffs, and supply chain constraints affecting the clean energy industry.

Dan Finn-Foley, Intertek CEA’s Director of Energy Storage Market Intelligence, joins the Currents podcast to discuss the impact of tariffs, shifting supply chains and emerging technologies on the US battery storage market.

The PV Price Forecasting Report provides independent market intelligence on changes in global supply chains and accurate forecasts for supply price scenarios based on technologies, materials, manufacturing regions and target markets, as well as supply and demand forecasts and analysis.

The quarterly published PV STPR covers global and regional supply chain analysis, technology trends, and regional policy analysis through early July 2025.

In this Energy Storage News webinar, Intertek CEA Market Intelligence experts Daniel Finn-Foley and Christian Roselund explore the implications of the U.S. budget reconciliation bill, H.R. 1, for the energy storage industry.

The PV SMIP provides a comprehensive and unbiased analysis of the top PV module manufacturers in the world. It offers detailed insights into capacities, technology, and efficiency roadmaps, along with Manufacturing, Capacity, and Technology (MCT) ratings for each supplier.

The ESS Price Forecasting Report provides an in-depth five-year forecast for the price of a DC battery container, including battery cells, modules, racking, and additional balance of system needed for a containerized battery system.

The quarterly published Energy Storage STPR covers global and regional supply chain analysis, technology trends, and regional policy analysis. This quarter the focus is on new efforts for stackable BESS technology, the potential for non-lithium-ion technology as a tariff solution, and insights from a battery fire safety expert on myths vs. reality and best practices.

The latest Energy Storage System (ESS) Supplier Market Intelligence Report includes concise and standardized analyses of major LIB cell suppliers and BESS integrators, focusing on global production capacities, product portfolios, and notable projects.

Christian Roselund, Intertek CEA’s Senior Policy Analyst, joins the SunCast Podcast to discuss the new House budget bill threats to solar.

This Interim Update of the Energy Storage System (ESS) Q1 2025 Price Forecasting Report highlights how newly imposed U.S. tariffs are reshaping the cost landscape for imported battery systems and components from China.

The latest Energy Storage System (ESS) Supplier Market Intelligence Report finds that the market landscape for lithium-ion batteries continues to evolve, and supplier strategy is shifting rapidly in response to the tariffs announced by the United States under the Trump administration, particularly on China, and persistently low prices.

Martin Meyers explores how the Inflation Reduction Act is reshaping U.S. solar manufacturing incentives and project economics. He highlights the evolving challenges developers face in navigating domestic content requirements and qualifying for bonus tax credits.

Intrtek CEA’s Senior Energy Storage Engineer Ahn Vu explores how alternative technologies to lithium-ion are unlikely to oust the incumbent anytime soon.