Mind the Gap: Demand for Storage Outpaces U.S. Manufacturing Capacity

by Daniel Finn-Foley

Daniel Finn-Foley of Intertek CEA discusses how lithium-ion batteries have rapidly reshaped the U.S. power sector, growing from about 1 GWh of installations in 2020 to more than 30 GWh by 2024. He warns that new tariffs and FEOC restrictions are straining supply chains, making early procurement crucial as compliant domestic capacity tightens.

Even within the U.S. electricity industry, which was built 143 years ago on a foundation of rapid and seismic change, energy storage’s emergence as a disruptive technology has outpaced any previous power technology’s growth. Lithium-ion batteries, driven by falling prices and seemingly endless technical innovation, are establishing themselves as the backbone of the grid of the future, integrating renewable energy, mitigating volatility, and bolstering resiliency and reliability.

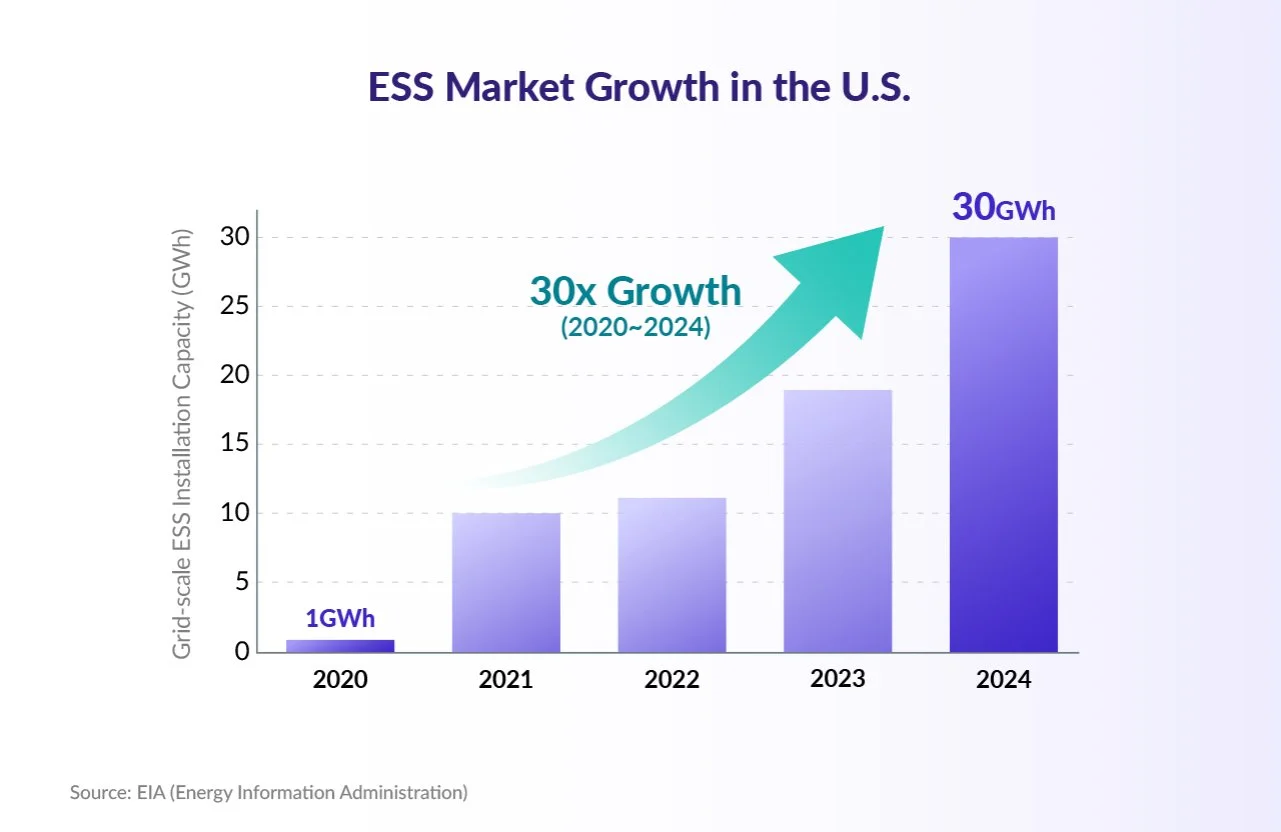

The pace of adoption for energy storage is historically unrivaled. Based on data from the Energy Information Administration (EIA) the U.S. installed just above 1 GWh of batteries onto the grid in 2020. By 2024, the annual total was more than 30 GWh, a 30x increase in the speed of deployments in only four years. Though more difficult to track, residential, commercial and industrial, and data center applications likely also contributed several additional GWh.

Source: EIA (Energy Information Administration)

This surge shows no signs of slowing, with annual installations of 50-70 GWh achievable in the next two years, and as much as 100 GWh a year likely towards the end of the decade.

The sudden need for energy storage could not have been better timed. Lithium-ion batteries have benefited from the economies of scale built by strong EV demand, creating a pathway to cost declines few other technologies could replicate. Batteries became more cost effective, more reliable, and each generation brought new leaps in energy density and cycle life.

Early emerging markets, primarily ancillary services where near-instantly responding batteries shined, proved storage’s potential, and developers and grid operators began asking “What else can energy storage do?” Deployments went from 15 or 30-minute durations in 2015 to 4-hour capacity applications. As costs continued to fall, more use cases became economically viable.

The transition has accelerated with the adoption of various battery cell chemistries. Instead of simply repurposing technology intended for electric vehicles, developers now use bespoke solutions purpose built for operating on the grid. As lithium-ion batteries proved their worth, the stationary storage market — though still small in scale compared to the GWh of manufacturing demanded by mobility applications — demonstrated its bankability and attracted investment.

The most significant shift has been, inarguably, the continuing transition from nickel manganese cobalt (NMC) chemistries — energy dense and well-suited to EVs — towards lithium iron phosphate (LFP) technologies. LFP batteries, with lower costs, high cycle life, improving energy density, and a favorable safety profile, have become the gold standard for grid applications.

Structural changes in the U.S. ESS market - Source: LG Energy Solution

But recent policy shifts have put the industry’s access to the technology at risk. While favorable pricing driven by economies of scale and technical innovation over the past 15 years, dual policy developments are bringing challenges for the stationary storage market, creating new price barriers and restrictions.

Provisions introduced in the recent budget law limit access to the 30% investment tax credit when using products from a country classified under Foreign Entities of Concern (FEOC), creating a significant barrier between developers and the historical primary suppliers of LFP batteries. Simultaneously, tariffs have increased dramatically, making importing from many countries prohibitively expensive.

The stationary storage industry has been left scrambling to adjust its supply chain to the new reality of high tariffs and FEOC restrictions. Surging demand has been put at risk by this shock in price and supply. Non-lithium alternative battery chemistries exist but have been challenged to scale against comparably inexpensive lithium-ion technologies as more capacity comes online.

Following 2022’s Inflation Reduction Act, investment surged into the United States to build out domestic battery gigafactories. But many of these early investments have stumbled amid financing concerns in 2025 and rollbacks of federal support.

So far in 2025, Intertek CEA has tracked more than 20 GWh of cancelled or delayed lithium-ion manufacturing for the energy storage market.

The news, however, is not all grim. A gap still exists, as much as 50%, between expected demand and likely domestic U.S. supply for stationary storage batteries. But recent announcements by South Korean vendors, including dedicated facilities to manufacture batteries for stationary storage applications, indicate that the use case is considered bankable enough to invest in, despite the regulatory uncertainty. Several are now re-purposing EV manufacturing towards energy storage applications, an increasingly favorable strategy as electric vehicle tax credits are phased out.

As a result of these investments by large-scale players, and pullback from emerging domestic U.S. manufacturers amid policy and regulatory uncertainty, the competitive landscape for FEOC-compliant capacity is increasingly concentrated. LG Energy Solution alone accounts for the majority of Intertek CEA’s forecasted likely U.S. LFP manufacturing capacity for 2028 and is the primary reason the gap between supply and demand is not even greater. Intertek CEA anticipates this trend to continue, but it is still unclear if the pace of announcements can match that of delays and cancellations, and if this gap could then spill into the broader market.

In the meantime, developers continue to move forward with renewed urgency to get projects in the ground, identify the most favorable use cases and geographies, and secure long-term supply that enables incentives and mitigates tariffs. Expect domestic U.S. capacity to become a hot commodity as first movers for new storage markets often reap the greatest rewards, putting a premium on procurement strategy to reduce the risk of delays.

Further strategies will continue to emerge as the global supply chain, vendors, and buyers adjust to the new normal, so stay on your toes and be ready to open the door when opportunity knocks — it may not knock twice.

This column reflects the author's opinion and does not contain LG Energy Solution's position or strategy.

Daniel Finn-Foley is Intertek CEA’s Director of Energy Storage Market Intelligence.